Top 5 most common user mistakes in DeFi

In this post, we’ll discuss the most common mistakes made by 1inch users. Learn from them and don’t repeat these mistakes!

We at the 1inch Network hate to see users lose their funds, even when it happens as a result of their own mistakes. Therefore, we have prepared a top 5 of the most commonly made mistakes for you to learn from.

1. Insufficient balance of native network tokens

This is, arguably, the most common issue that new users are faced with. The 1inch dApp is available on five blockchains — Ethereum, Binance Smart Chain (BSC), Polygon, Optimistic Ethereum and Arbitrum. On each of these networks, each transaction requires a fee, normally known as a gas fee. Gas fees are sent directly to the network’s miners and, therefore, have to be paid in native network tokens. If you don’t have enough native tokens on your balance to pay the gas fee, your transaction won’t go ahead.

To learn more about how gas fees work, read this article.

2. Misunderstanding of the token approval/unlock mechanism

Before any transaction with tokens can go ahead, your tokens need to be approved, or unlocked. Approvals are considered an industry standard across all decentralized exchanges and serve to protect your wallet from being accessed by a smart contract without your permission. By ‘unlocking’ your tokens, you give permission to the 1inch smart contract to spend your assets.

Although some users may see this as an inconvenience, your transaction cannot be executed, unless your tokens are unlocked. So, you have to pay a gas fee to unlock your tokens. It should be stressed that 1inch retains no part of gas fees for token approval, which go to miners of the network in which your transaction will run.

You can learn more about the token unlock process from this article.

3. Sending tokens to the wrong chain

As mentioned above, the 1inch dApp is available on four blockchains. Most tokens are only operable within a specific network, and if you send your funds to another network, you will lose your coins. Avoiding this mistake is easy: when making any transaction, make sure that your wallet is compatible with the network you want to send tokens to and that the correct network is selected.

For more info on how to migrate tokens between chains, check out this article.

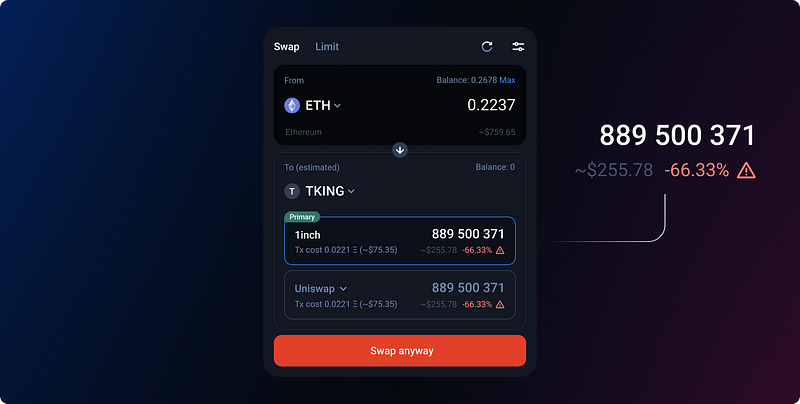

4. Failure to understand how liquidity pools work

Swapping tokens in a liquidity pool, a user could be hit with price impact, meaning that they would have to swap their tokens at a very unfavorable rate, if there isn’t enough liquidity in the pool. Price impact directly correlates with the amount of pool liquidity and can be especially high for illiquid markets/pairs, causing a user to lose a large portion of their funds.

See more on liquidity and price impact in this article.

5. Investing in tokens without proper research

Many users are impressed by the enormous growth that some tokens have recently seen and want to make a quick buck by investing in those tokens. However, a sharp increase in a token’s price could be the result of pumping or shilling by a popular influencer on social media. Tokens of that kind can show remarkable growth only to lose most (or all) of its value within days or even hours. By investing in pumped or shilled tokens, you set yourself up for losing your funds. In the crypto space, there are quite a number of scam projects whose sole purpose is to strip users of their hard-earned money. The best way to avoid falling for scams is proper research.

Here’s a “quick and dirty” token research checklist:

- Is there substantial liquidity and trading activity (both buys and sells)?

- Does the token’s creator have a reputable history?

- How big is the community, team, and web presence behind the token?

- Has anyone else experienced issues buying/selling the token? (Telegram channels and block explorers are great sources of this information).

We hope that knowledge about mistakes discussed above will help you to avoid losing funds while using 1inch. Stay tuned for more useful tips and updates!