The 1inch Davos meetup: Institutional adoption of decentralized finance 2024

This is the first post in a series focused on the highlights of panels held as part of 1inch’s meetup “Institutions and DeFi” at the World Economic Forum Annual Meeting in Davos on January 16.

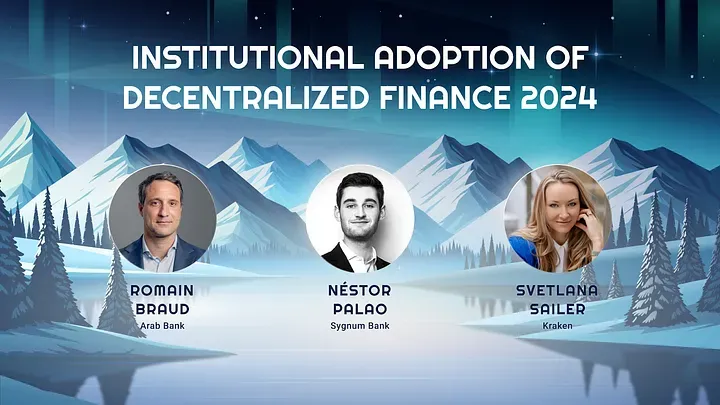

The meetup kicked off with a panel discussion titled “Institutional adoption of decentralized finance 2024: What we need going forward.” The panelists were Romain Braud (BD Director of Arab Bank), Néstor Palao (Head DLT & Corporate Clients at Sygnum Bank) and Svetlana Sailer (Kraken’s Institutional Relations and Solution Manager for the EMEA region). Christine Lee, a senior anchor at CoinDesk, moderated the discussion.

In the wake of the recent approval by the Security and Exchange Commission (SEC) of Bitcoin ETFs, the adoption of DeFi by institutions is expected to be a hot topic in 2024. However, institutional DeFi is still in early adoption stages, the panelists admitted.

“We are still early in institutional DeFi,” said Romain Braud. "[But] it’s about building an infrastructure globally that will help to develop [DeFi].”

“Yields [in DeFi] are still relatively high,” added Svetlana Sailer. “The price discovery is still happening. Once that matures, the yields will naturally drop. They won’t probably drop to the level of repo because we don’t have middlemen. [Although] BlackRock says we are ages away from institutional adoption of DeFi, it depends on the region where those institutions are.”

Gradually, institutions are already making their first steps into the terrain of DeFi. “The first steps of institutions into DeFi concern blue chips,” explained Néstor Palao. “They see this industry as an alternative asset class and they want to get exposure to Bitcoin and Ethereum, mainly. After that, it’s probably DeFi.”

However, to make DeFi more attractive for institutional players, several issues have to be dealt with.

“One is regulation,” Néstor Palao said. “We need a proper framework by which institutions will access DeFi because accessing the permissionless market is too challenging for them. Second, there is the issue of scalability. Institutions service millions of customers, and they need to access the networks at this scale. Third, it’s the complexity of products. [There is a need for] more complex financial solutions that mirror what is going on in traditional finance.”

Another challenge to onboarding institutions is security. According to Svetlana Sailer, hacks for a total of $1 bln occurred last year. "[Attacks against] bridges, compromised keys, draining of liquidity pool - this is something that doesn’t happen in traditional finance,” she elaborated. “Institutions need to find ways to tackle these challenges.”

Still, DeFi also opens attractive opportunities for institutions.

“There are quite a few advantages for institutions in that space, and efficiency is one of them,” noted Svetlana Sailer. "[DeFi] is built using smart contracts, which save time and money and eliminate middlemen, making things faster and easier for everyone. You can reach your clients 24/7, you can include new markets, expand your geographical boundaries.”

“There are some new trends, such as separating the execution from the custody,” added Romain Braud. “And that’s where we want to go as a bank.”

Meanwhile, overall, the panel’s experts were optimistic about the prospects of DeFi.

“I believe that DeFi is here to stay,” said Néstor Palao.

“It’s inevitable that the traditional finance system will use blockchain technology and DeFi within a decade,” concluded Svetlana Sailer. “It’s just a matter of regulation and a framework. We are heading towards adoption.”

Explore the DeFi space with 1inch!