How Okto leverages 1inch's Swap API to deliver seamless trading experience

The integration of 1inch's advanced swap functionality has enabled Okto, the first live chain-abstracted wallet, to provide its users with optimized trading experiences across EVM-compatible networks.

By harnessing the power of 1inch's liquidity aggregation and price route discovery technology, Okto has successfully overcome critical challenges in the fragmented DeFi landscape, resulting in faster, more reliable and cost-effective token swaps for its growing user base.

Okto: Simplifying Web3 access

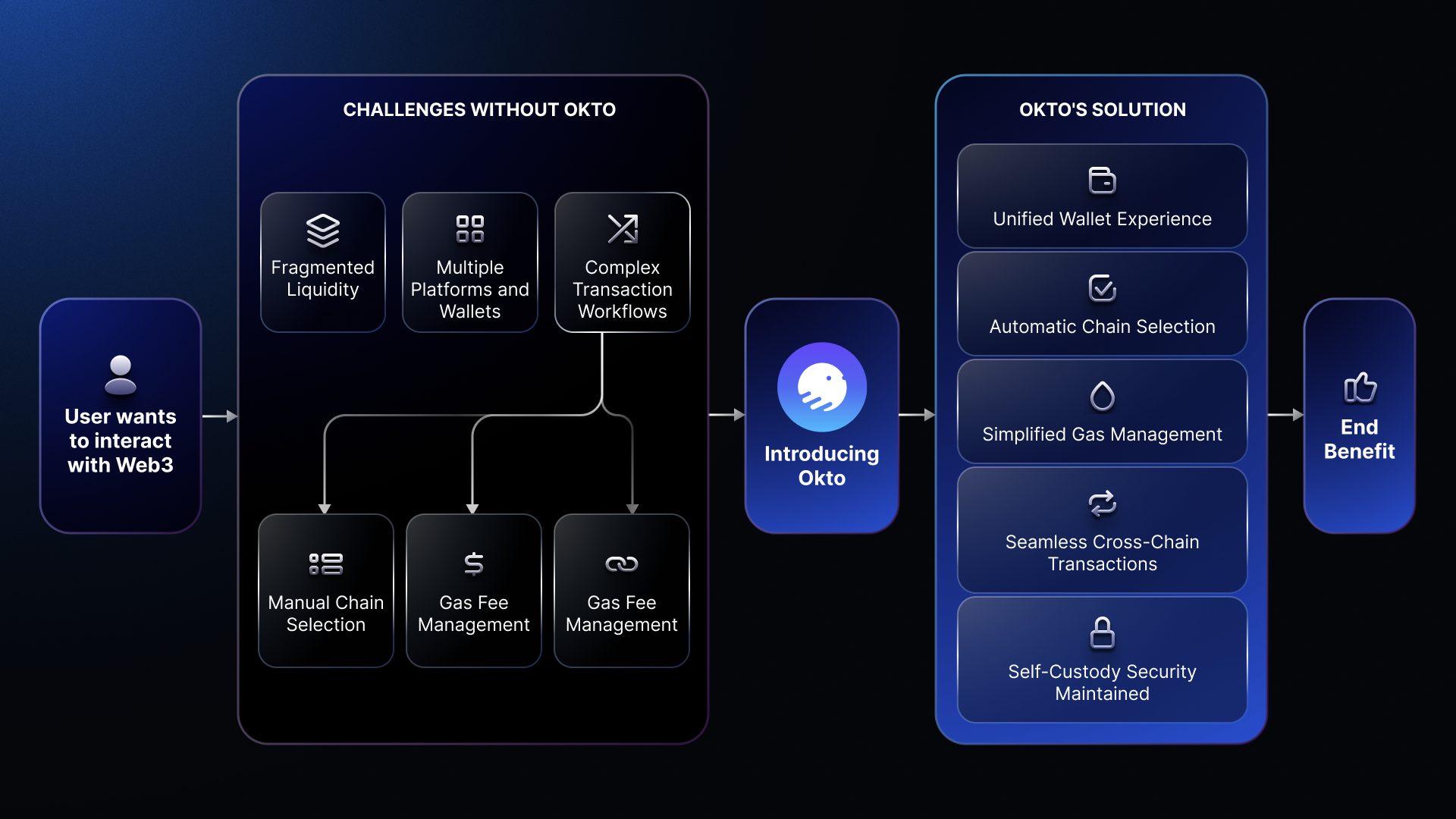

Okto has positioned itself with a clear mission: "Experience Web3, The Easy Way." As the first live chain-abstracted wallet, Okto aims to shield users from the underlying complexities of blockchain mechanics while maintaining the security benefits of self-custody.

Before achieving its current capabilities, Okto faced significant challenges inherent to the DeFi ecosystem. The fragmentation of liquidity across isolated blockchains forced users to navigate multiple platforms and wallets, creating inefficiencies and limiting access to optimal trading opportunities. Complex transaction workflows—requiring manual chain selection, gas fee management, and cross-chain bridging—created substantial friction, particularly for newcomers to the space.

Initial challenges

Okto identified three primary metrics they needed to optimize:

- Speed - Ensuring rapid transaction execution

- Reliability - Providing consistent access to liquidity

- Cost - Minimizing transaction fees and slippage

Additionally, slow transaction speeds on congested networks eroded user trust, while the lack of a unified interface to aggregate liquidity and abstract blockchain complexities left traders navigating a disjointed ecosystem. Okto needed a solution that could deliver seamless and abstracted swap experiences, allowing users to trade between a large number of pools without encountering errors.

Why Okto chose 1inch

After evaluating various options including competitors like Uniswap, Li.Fi, and Socket, Okto selected 1inch as their primary swap provider for several compelling reasons:

Superior liquidity aggregation

1inch has integrated the highest number of decentralized exchanges (DEXes) and liquidity pools across EVM-compatible chains, providing Okto users with unparalleled access to trading opportunities. This extensive coverage ensures that even trades involving rare token pairs can be executed efficiently.

"1inch has integrated the most number of dexes at their end... liquidity would be the highest on this naturally," noted Rohit Jain, Head of Okto. This deep liquidity pool integration gives Okto users access to uncommon trading pairs that might not be available through other providers.

Advanced routing technology

The sophisticated Pathfinder algorithm developed by 1inch identifies optimal routing paths for token swaps, often splitting transactions across multiple liquidity sources to achieve the best possible rates. This technology is particularly valuable when direct pools between specific tokens don't exist.

For example, when a user wants to swap a token like SHIB to another token like BONK on the same chain, there might not be a direct liquidity pool connecting these assets. 1inch's Pathfinder automatically determines the most efficient routing through intermediate tokens (such as USDC), optimizing the entire transaction path.

Performance and reliability

Okto observed that 1inch consistently provides faster execution compared to alternatives, a critical factor in volatile markets where timing significantly impacts trade outcomes. Reliable infrastructure ensures consistent performance even during periods of high market volatility.

How Okto integrates 1inch technology

Okto has implemented a comprehensive integration with 1inch that powers a significant portion of their trading functionality:

Same-chain EVM swaps

Okto exclusively uses the 1inch Swap API for same-chain swaps on EVM-compatible networks. This integration handles approximately 76-80% of Okto's total swap volume, highlighting the central role 1inch plays in their ecosystem.

Cross-chain bridging support

While the 1inch Swap API directly handles same-chain swaps, it also plays a crucial role in Okto's cross-chain functionality through what they call "inline bridge" operations. This process involves:

- Converting the source token to a stable token (like USDT) on the origin chain using the 1inch Swap API.

- Bridging the stable token to the destination chain through Okto's infrastructure.

- Converting the stable token to the desired token on the destination chain, again using the 1inch Swap API.

For example, if a user wants to swap SHIB on BSC to BONK on Base, Okto would first convert SHIB to USDT on BSC using the 1inch Swap API, then bridge the USDT from BSC to Base, and finally convert USDT to BONK on Base using the 1inch Swap API again.

Technical implementation

The integration between Okto and 1inch was straightforward, thanks to 1inch's comprehensive documentation and API structure. Okto implemented the integration with specific customizations to ensure optimal performance for their users:

- Slippage management: 1inch honors the slippage tolerance set by Okto, ensuring that users maintain control over their trade parameters

- Quote generation: The integration provides real-time price quotes with accurate gas estimations

- Complex routing abstraction: 1inch handles the complex logic behind determining optimal swap routes, abstracting this complexity from both Okto's development team and end users

Benefits and outcomes

The integration of 1inch's technology has delivered substantial benefits to both Okto as a platform and its end users:

- Enhanced user experience. By leveraging 1inch's liquidity aggregation, Okto provides users with a seamless trading experience that abstracts away the complexities of DeFi. Users can access deep liquidity and competitive rates without needing to understand the underlying mechanisms of blockchain technology.

- Expanded trading capabilities. The integration enables Okto users to trade a wider range of tokens, including rare pairs that might not be supported by individual DEXes. This expanded token support has been crucial for Okto's mission of making DeFi more accessible.

- Technical efficiency. For Okto's development team, the 1inch Swap API has simplified the implementation of complex swap functionality:

- Reduced development overhead: Instead of building and maintaining their own routing algorithms, Okto leverages 1inch's battle-tested technology

- Standardized API endpoints: The well-structured API reduces development complexity and maintenance costs

- Reliable infrastructure: 1inch's robust architecture ensures consistent performance

Performance metrics

The implementation of the 1inch Swap API functionality has directly addressed Okto's initial challenges:

- Speed: Faster trade execution through optimized routing.

- Reliability: Consistent access to liquidity across market conditions.

- Cost: Reduced slippage and competitive pricing through liquidity aggregation.

Future collaboration

With the anticipated launch of Okto Chain, the partnership between Okto and 1inch is set to evolve further. Okto plans to leverage 1inch's technology on both sides of cross-chain transactions, creating an even more seamless experience for users trading between different blockchains.

The collaboration between Okto and 1inch demonstrates how specialized protocols can work together to overcome the inherent challenges of the fragmented DeFi landscape. By integrating 1inch's advanced Swap API, Okto has been able to deliver on its promise of making Web3 easy and accessible while maintaining the benefits of decentralization.

For users, this partnership translates to faster, more reliable, and cost-effective token swaps across a wide range of assets. For the broader DeFi ecosystem, it represents a step toward greater interoperability and accessibility—key factors in driving mainstream adoption of decentralized finance.

Through the continued collaboration between innovative platforms like Okto and specialized protocols like 1inch, the vision of a more accessible and efficient DeFi ecosystem comes closer to reality.

Stay tuned for more 1inch integration case studies!