Introducing 1inch v2 — DeFi’s fastest and most advanced aggregation protocol

We are thrilled to unveil 1inch’s version 2. The main highlights are Pathfinder, an API that contains a new discovery and routing algorithm, and an intuitive, user-friendly UI. The improvements ensure the best rates on swaps, while dramatically cutting response time.

TL; DR

- Swaps are split across 21 supported liquidity protocols, using different ‘market depths’ within the same protocol.

- 1inch’s enhanced UI got an intuitive and user-friendly design.

- Response times are the fastest on the market for comparable complexity levels.

- All major protocols are supported, including Uniswap v1 and v2, Balancer, Curve, Kyber, SushiSwap, DODO, Oasis, Mooniswap, and many more.

- 1inch can pack, unpack and migrate collateral tokens from Aave and Compound as part of the swap path.

- Thanks to the partial and dynamic fill mechanism, the probability of failed transactions has been dramatically reduced.

Pathfinder

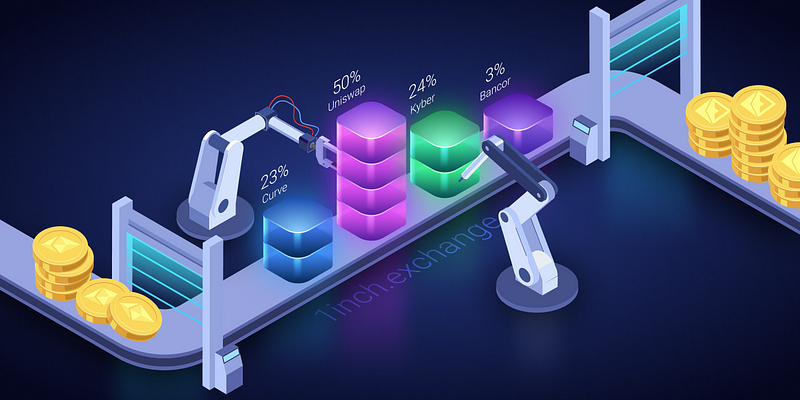

In our strive to offer the best rates at the best speed, we are happy to bring you 1inch version 2. The main component of the release is Pathfinder, an API containing a new discovery and routing algorithm, which finds the best possible paths for a token swap in the shortest possible time.

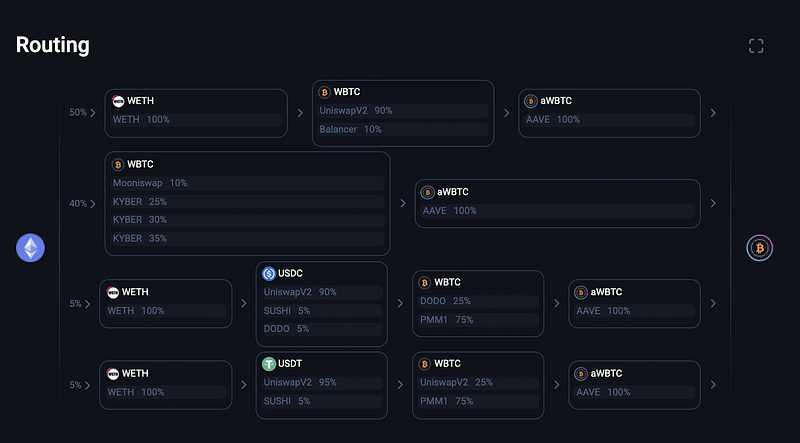

In addition to splitting a swap across multiple supported liquidity protocols, the new Pathfinder algorithm utilizes multiple ‘market depths’ within the same protocol. The utilization of ‘market depths’ is a major improvement.

Pathfinder uses different ‘market depths’ as bridges between source and destination tokens. Thereby, the algo uses a more sophisticated approach than just splitting a swap across different protocols. In addition, it can split part of the swap for a specific protocol between different ‘market depths’ on the same protocol, getting the user the best rates, also taking into account gas consumption.

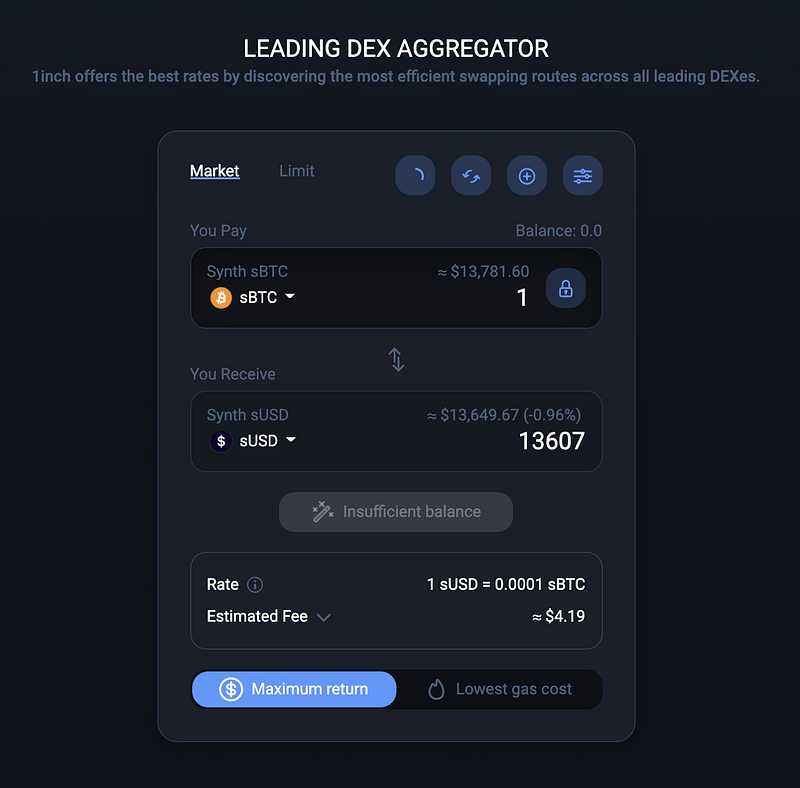

Thanks to improved quotes, 1inch offers, for instance, a rate for 1 sBTC-sUSD that’s better than Uniswap’s offer by almost 98%.

UI improvements

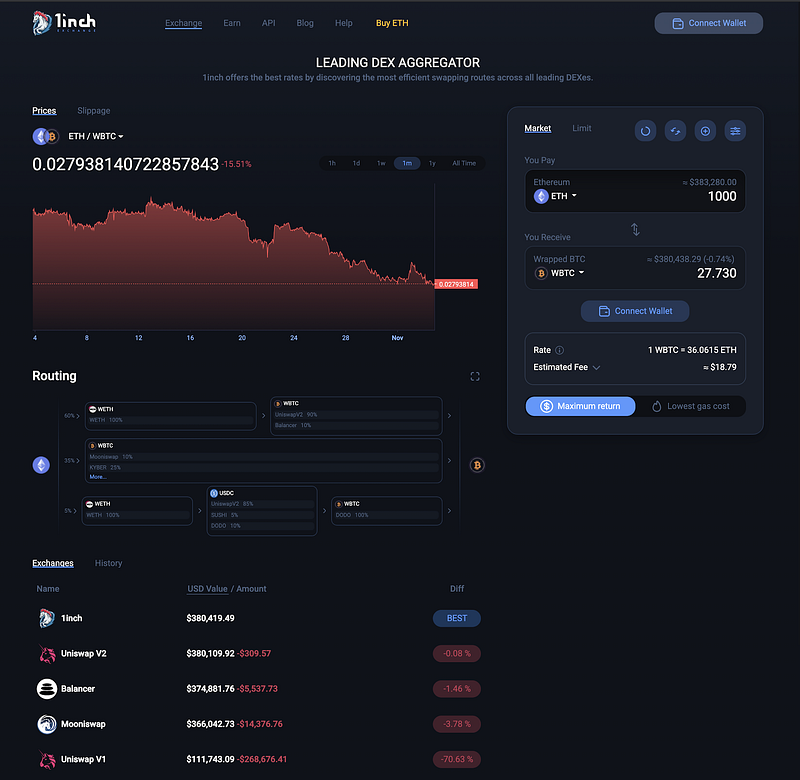

The new user interface, which was built completely from scratch, offers a much better user experience than the previous version. Taking into account suggestions from users, we aimed to make the UI as intuitive and user-friendly, as possible.

We have also added a table showing a user’s return value in USD. Previously, we showed how many coins a user gets and the size of the gas fee. Now, the user sees an entire value of their deal in USD.

The UI is built on a module model. There is a basic swap module, which contains all necessary information in a minimal format, and two extra modules: a price chart for a selected pair and a comparative table (something that you might be already familiar with if you’ve used 1inch before). Users can combine these modules in any way that’s most convenient for them.

Fastest on the market

1inch v2 has a range of improvements on the previous version, but one of the most vital improvements, the effect of which users are set to feel immediately, is much higher speed:

- compare quote response time has been reduced from 6 sec to 0.4 sec;

- page load time has been reduced from 5 sec to 1 sec;

- API quote response time has been reduced from 5 sec to 0.4 sec.

Versatility

1inch v2 supports all major protocols:

Uniswap V1, Uniswap V2, WETH, Balancer, Curve, Chai, Sushiswap, Kyber, Oasis, Mooniswap, Compound, Aave, Yearn, Bancor, PMM, C.R.E.A.M. Swap, Swerve, BlackholeSwap, Value Liquid, DODO, Shell.

We are working on adding more private market makers soon.

Collateral tokens

Thanks to Pathfinder, users will be able to pack, unpack and migrate collateral tokens from lending protocols Aave and Compound, as part of the swap path.

Aave and Compound are lending protocols that pack other tokens into collateral coins, such as, for instance, Compound’s USD-pegged coin, cUSD. Users can hold collateral coins, but to unpack them or pack back into collateral coins as well as to migrate them to another pool, they have to go to the lending protocol that issued them.

With our new version, a user can do all that on 1inch with just one transaction, saving users both time and money. On 1inch, users can also easily swap collateral coins held in pools, with all packing/unpacking done automatically.

Partial and dynamic fill mechanism

We’ve been working hard on reducing the probability of failed transactions. Our solution is the partial and dynamic fill mechanism.

When a user makes a swap on 1inch using splits or various routes, we make sure that the swap is done at the rate the user was offered in the UI. If the rate on one of the protocols has changed, one part of the route can be easily cancelled. Instead of a failed transaction, the user’s unswapped coins return to their wallet.

The dynamic component comes into play to allow parts of the swap to immediately switch to another protocol in the split or path. For instance, a swap is split between Uniswap, Sushiswap and Balancer. If the Uniswap swap has failed, the entire swap will switch to Sushiswap and Balancer. This allows the swap to still execute within the bounds of the user’s acceptable rate.

Swap overhead optimizations

We reinvented our aggregation smart contract proxy to build highly complex transactions. The 1inch v2 smart contract was built entirely from scratch. Version 2 reduces aggregation overhead gas costs to almost zero for direct swaps, e.g. on Uniswap. Complex (multi-path) swaps are also optimized to minimize gas costs.

Maximum return and lowest gas

Among Pathfinder’s new features are also the ‘Maximum return’ and the ‘Lowest gas’ options. If a user chooses the former option, complex routes are used for the swap to make sure that the user gets the best rates. In the ‘Lowest gas’ option, swaps are done at market rates, without splits across different exchanges or complex routes, which enables the user to pay the lowest possible gas fee.

Security audits

1inch v2 smart contract has passed 5 security audits: Certik, Hacken, Scott Bigelow, Mix Bytes and Chainsulting. We are waiting to receive completed audits from OpenZeppelin, Consensys diligence, SlowMist, Haechi Labs, Coinfabrik soon.

To Conclude

- We have built an attractive and user-friendly interface for swaps.

- Pathfinder displays current prices for virtually all possible crypto pairs in real-time.

- We have substantially reduced failed transaction risks with the partial and dynamic fill mechanism.

These improvements enable 1inch v2 to save users more money on swaps than any other protocol on the market. Now, go ahead and try 1inch v2 today!