Improvements proposed to the 1inch governance model

The introduction of the Treasury aims to facilitate the most efficient use of the revenue stream to ensure the project’s sustainable development.

Based on suggestions made by the 1inch community over the last few months, a proposal has been made to improve the 1inch governance system.

The 1inch Network’s governance system has existed since December 2020. In June 2021, it was revamped. Now, time has come to make another step towards transparent and sustainable governance by introducing the Treasury.

The Treasury proposal gathers all ideas that have been voiced by the 1inch community.

The Treasury’s central component is the Trading Strategy, a stable liquidity pool powered by the 1inch Aggregation Protocol. The Trading Strategy is executed as a newly-created fund subsidized exclusively by the 1inch Network protocols’ current revenue streams.

Managed by the 1inch DAO, all operations of the Treasury will be fully autonomous. All decisions regarding the allocation of the Treasury’s funds will be made by voting through the 1inch governance process.

Treasury governance

1inch Governance

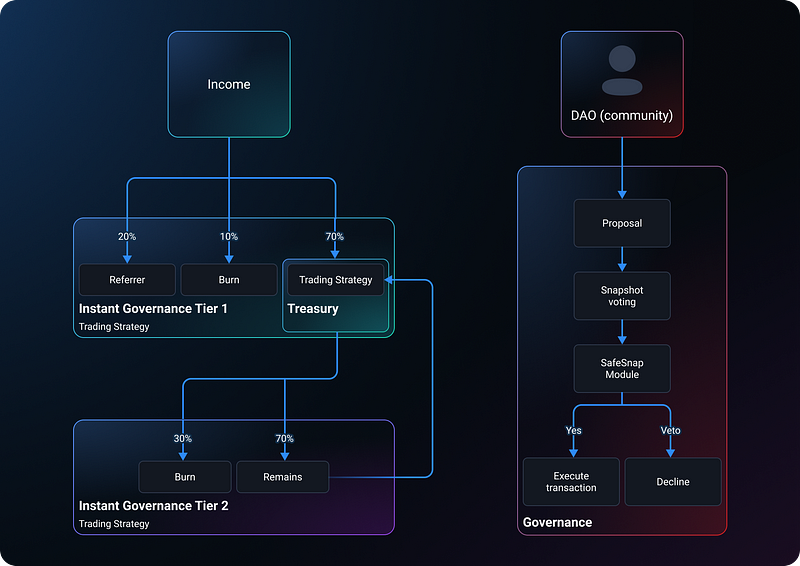

Treasury governance will consist of two layers of Instant Governance and a separate Governance system focused on community proposals and administered via Snapshot and SafeSnap voting.

On tier 1, 1INCH stakers and vested token holders will be able to vote on the revenue stream distribution. This innovative tool will offer all available options, including token burning, payouts to referrers and depositing of tokens to the Trading Strategy (described in detail below).

Two types of tokens can be used for voting. st1INCH represent staked 1INCH tokens, and v1INCH tokens represent 1INCH tokens held in the vesting smart contracts and owned by backers, advisors and core contributors. (For more on 1INCH distribution, see this post.) st1INCH and v1INCH have the same voting power.

On tier 2, 1INCH stakers and vested token holders will direct the allocation of Treasury funds via Snapshot voting. The majority of this allocation would cover project development costs, while the remainder would be sent to a secondary burn address.

The Trading Strategy

The Trading Strategy will be executed as a 1inch liquidity pool of two industry-standard stablecoins (USDC-USDT). This automated market maker (AMM), highly profitable and optimized for the USDT-USDC pair, will be integrated as a liquidity source to the Pathfinder algorithm. Earnings are estimated to be around 5–10% APY. The Trading Strategy is viewed as fully open-source and available for various integrations.

SafeSnap

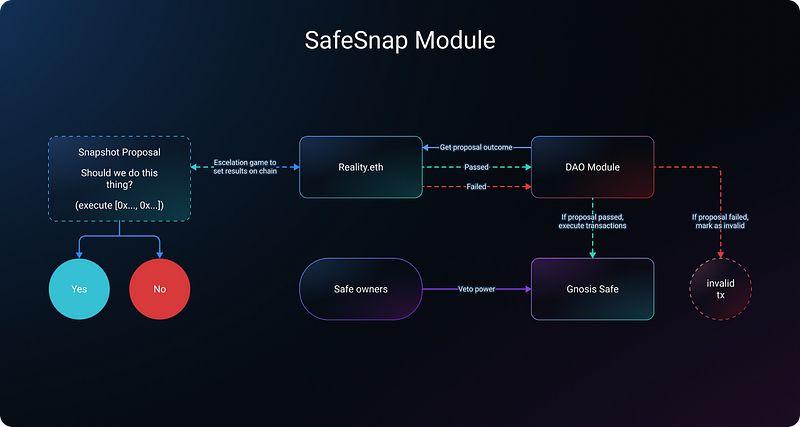

The Governance process will use SafeSnap as a module enabling on-chain execution of off-chain votes.

SafeSnap facilitates the execution of transactions that have been approved via a Realitio question for execution. A question asked on Realitio consists of a proposal ID (e.g. an ipfs hash) that can be used to provide more information for the transactions to be executed, and an array of EIP-712-based transaction hashes representing the transactions to be executed.

SafeSnap Module (source: https://blog.gnosis.pm/introducing-safesnap-the-first-in-a-decentralized-governance-tool-suite-for-the-gnosis-safe-ea67eb95c34f)

Check out the detailed proposal on 1inch Governance Forum: https://gov.1inch.io/t/1inch-network-treasury/2407

Overall, the Treasury should come as the next step towards full-fledged community governance of 1inch protocols, enabling a sustainable, long-term model for revenue stream distribution.