Algorithm update on 1inch

1inch.exchange offers now not only the best prices on the DEX market, it also calculates and respects the transaction gas costs.

Our own dynamic algorithm for splitting token swaps among DEXes got a small upgrade for respecting also the gas cost to each liquidity source. Before the update, every swap was splitted only by best return token amount. This was not optimal and produced sometimes high gas costs. It was very painful / expensive for small amounts around 5$ and less. Also on higher amounts it was possible to get more return tokens, but in the same time paying much more for gas costs. The gas token was mainly used to reduce this overhead, but it was like this:

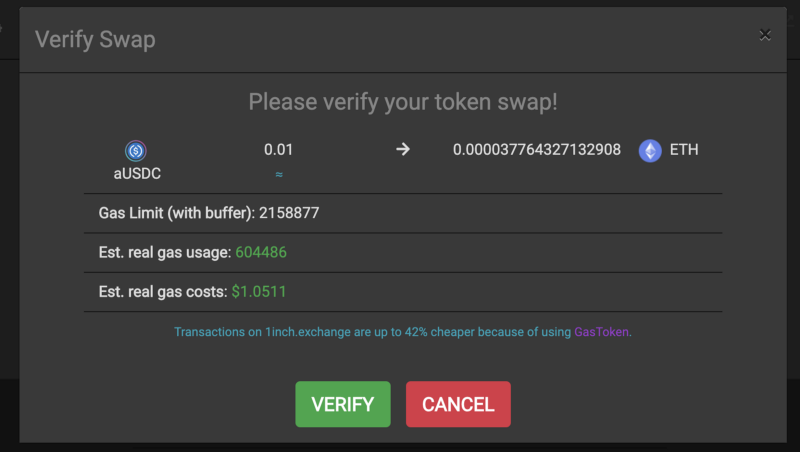

Now 1inch.exchange shows best prices on the DEX market by respecting the transaction costs and present also estimated costs in the verification popup:

Gas limit (with buffer) is over estimated to make it possible to burn GST2 / gas token and also cover our backup swaps if some of the main swaps would fail. (this we will explain and present how it works soon)

Here the official release note on Twitter: