1INCH token is released

With the new 1INCH token, 1inch Network will now be governed by a DAO.

The independent board of the 1inch Foundation has released 1INCH, a governance and utility token. The 1inch Foundation intends to support the adoption of the 1INCH token via the permissionless and decentralized 1inch Network.

The 1INCH token will be used to govern all 1inch Network protocols, taking governance in the DeFi space to a new level.

Pioneering governance solution

DeFi is a rapidly evolving space, but most governance models are not designed to adopt protocol changes quickly to respond to the rapidly evolving market. To remedy this, 1inch Network is launching with “instant governance”, a new feature that allows the community to vote for specific protocol settings under the decentralized autonomous organization (DAO) model, in a transparent, user-friendly and efficient way.

Instant governance is a new kind of governance where the community can participate, benefit and vote for specific protocol settings without any barrier to entry.

In instant governance, every user’s vote matters!

The 1INCH token will be used in all current and future protocols within 1inch Network, starting with the 1inch governance Aggregation Protocol and the 1inch Liquidity Protocol governance modules.

Aggregation Protocol Governance

The Aggregation Governance module enables 1INCH token stakers to vote on Spread Surplus settings in the 1inch aggregation contract.

The Spread Surplus is generated by swap transactions when the executed price is slightly better than the price quoted.

Note that the 1inch Pathfinder algorithm always provides users the most current and best possible prices on a swap. However, the swap price sometimes moves between the time of the quote and the time that the transaction is mined — resulting in a Spread Surplus.

The Spread Surplus that is dedicated to 1INCH stakers will initially be set to 0%, with all Surplus going to referrers. This can be changed via 1inch governance.

The Spread Surplus can be claimed by governance participants and referrers in 1INCH token.

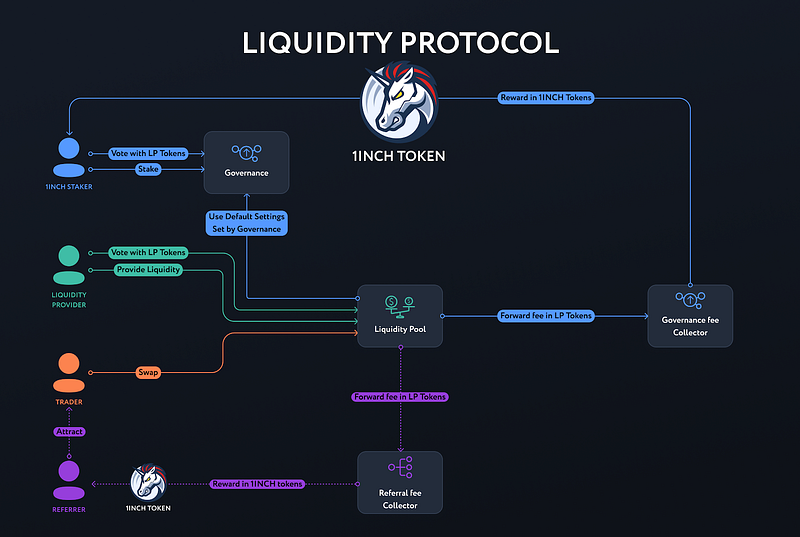

Liquidity Protocol Governance

Version 2 of the 1inch Liquidity Protocol is live. This is an upgraded and rebranded version of our version 1 AMM known as Mooniswap.

The key feature of the 1inch Liquidity Protocol version 2 is the price impact fee. This is a fee that grows with price slippage to ensure that liquidity providers and 1INCH token stakers earn significantly more on volatility.

Users who stake their 1INCH tokens, as well as liquidity providers in the 1inch Liquidity Protocol can vote directly on major protocol parameters: the price impact fee, the swap fee, the governance reward, the referral reward, and the decay period.

All voting will be done with the 1INCH token, which has no financial value. The community will determine protocol fees and the distribution of rewards.

There will be two types of governance: pool governance and factory governance.

Pool governance will include the configuration of parameters that are specific to each pool, such as the swap fee, the price impact fee and the decay period.

Factory governance is responsible for parameters shared by all pools, such as the default swap fee, the default price impact fee, the default decay period, the referral reward and the governance reward.

Swap fee

The swap fee is a fixed fee charged on each swap on the protocol.

Price impact fee

The price impact fee is a dynamic swapping fee charged on each swap and based on the price impact incurred. In the first version of Mooniswap, the system adds a decay period (time delay) when adjusting asset prices, which makes arbitrage more competitive and adds protection from front-running attacks. Over the past four months, 1inch validated its thesis that this decreases arbitrageurs’ profits and increases liquidity providers’ profits. The price impact fee adds an extra dimension to our AMM design.

Based on 1inch team’s simulations, the price impact fee could increase liquidity providers’ revenues by several times (in comparison to existing solutions). This is possible even on a market with fairly distributed volumes.

Decay period

The decay period is a unique feature that protects traders from front-running attacks and prevents arbitrage traders from easily extracting value from pools. Longer decay periods lead to a wider price spread in the pool after trades. 1INCH stakers can set a decay period between 1 minute and 5 minutes.

Governance reward

The governance reward is introduced to compensate stakers for their participation in the 1inch Liquidity Protocol governance. The reward is sourced from the swap fee and the price impact fee. The DAO governs the size of both of these fees.

Referral reward

This reward is a part of the swap fee and the price impact fee which will be dedicated to referrers (dApps and wallets that attract users and trading volume). Referrers can subsequently claim their share of 1INCH tokens from all pools in one gas-efficient claim transaction.

Voting procedure

Each 1INCH token holder can stake their 1INCH tokens to vote for the protocol parameters described above. Liquidity providers can participate in governance of their pool directly with their LP tokens. The weight of each user’s vote is proportionate to the amount of tokens they have staked. The protocol uses a weighted average of all votes, applying it linearly within 24 hours. Non-voting liquidity providers automatically delegate their votes to 1INCH token stakers.

1INCH distribution

All wallets that have interacted with 1inch until December, 24, midnight (UTC), will receive 1INCH tokens as long as they meet one of the following conditions: at least one trade before September, 15, OR at least 4 trades in total OR trades for a total of at least $20.

1inch liquidity providers will also receive their 1INCH tokens based on the liquidity mining program’s stages 1 and 2, announced earlier this fall.

Moreover, a new liquidity mining program for 6 liquidity pools will be introduced. These liquidity pools are intended for bootstrapping the 1inch Liquidity Protocol by using the 1INCH token as a utility connector token, not for speculative purposes.

1INCH tokens will be additionally distributed to users who provide liquidity for these 6 pools:

During the first two weeks of the current incentive program, another 0.5 percent of the 1INCH token’s total supply will be distributed to liquidity providers. Subsequent liquidity mining programs will be determined by 1INCH holders and community members.

In order to ensure a fair launch and give users adequate time to prepare, the 1inch liquidity mining program will be launched on December 26, midnight (UTC).

1INCH circulating supply

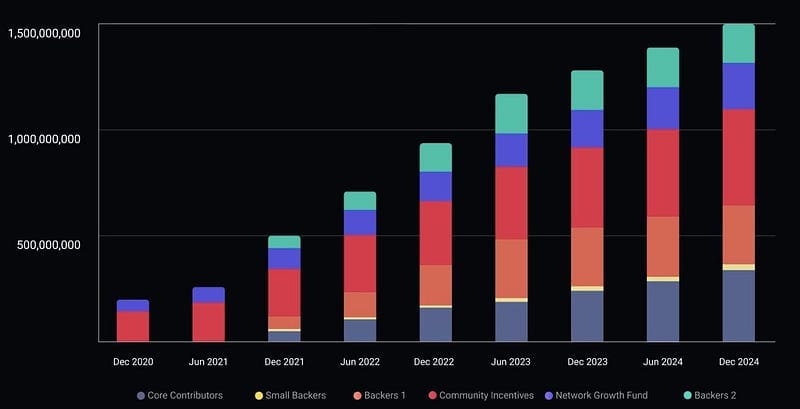

The initial circulation supply on the release day will be 6% of the total issuance plus 0.5% during the first two weeks of the liquidity mining program. The current total supply is 1.5 bln 1INCH tokens.

Token unlock schedule

Community incentives

30% of the total token supply has been allocated to community incentives, and they will be unlocked and distributed over the next 4 years. The goal is to step up the level of decentralization in the DAO and give each community member an opportunity to take part in protocol governance and influencing the protocol’s security.

Protocol growth and development fund

14.5% of the supply, unlocked over a 4-year period, will form the protocol growth and development fund. It will be used to issue grants, to attract developers to build on and improve 1inch protocols, to finance audits, and to compensate users for their losses due to any kind of unforeseen circumstances.

Looking into the future

This is the first iteration of 1inch governance. The more users that are onboarded, the more efficient and transparent the governance process will become. All community members are invited to submit their valuable feedback and proposals related to any governance issues on our new Github repository for 1inch improvement proposals (1IP).

Stay tuned!

P.S. The 1inch team wishes you a joyous Christmas! 🎅🏽🎄🎁