1inch takes leadership in the DEX segment

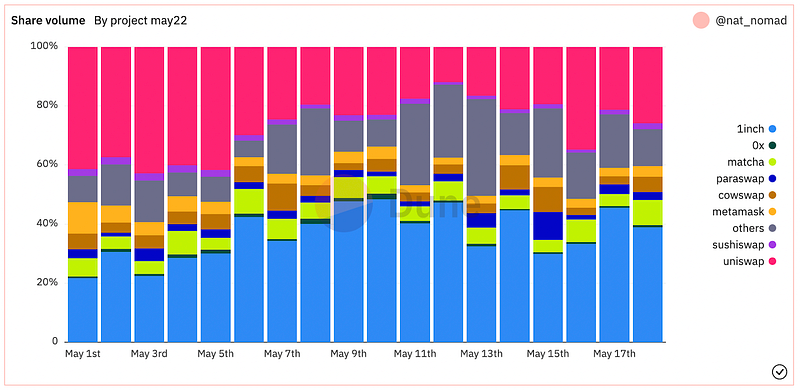

Since early May, 1inch has become the leader in the DEX segment, outperforming, among others, Uniswap, the largest DeFi project in user numbers.

This month, 1inch has seen tremendous growth in swap volume among all DEXes, emerging as the segment’s undisputed leader.

“The 1inch Network is delighted to emerge as the DEX segment’s top performer,” comments Sergej Kunz, 1inch Network co-founder. “Importantly, this achievement coincided with 1inch’s third anniversary celebrated this month.”

“The 1inch Network continues its work aimed at offering the best products and tools in the DeFi space,” he adds.

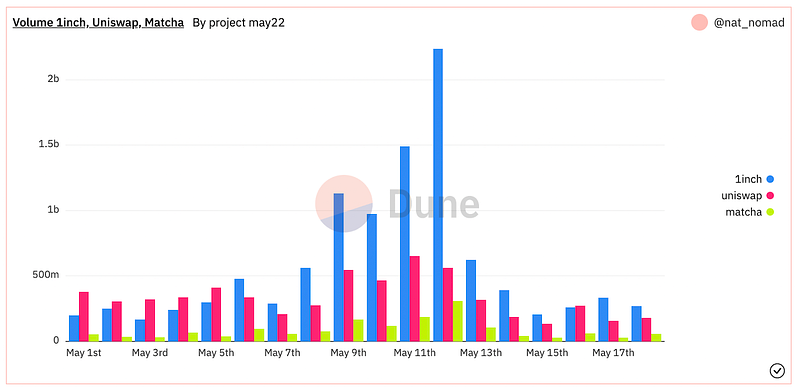

Incidentally, the trend started days before the “crypto bank run,” caused by the collapse of Luna and TerraUSD (UST).

However, high volatility on the market usually leads to high trading volumes, and the recent crypto bank run wasn’t an exception. Predictably, the highest volumes across the DEX segment were seen on May 12, when scores of users did swaps to get rid of coins they no longer had confidence in.

On May 12, 1inch saw an astounding figure of over $2.2 bln in 24-hour trading volume on the Ethereum network, according to Dune Analytics. 1inch’s ATH signified a roughly 8x increase over an average 24-hour volume of about $300 mln.

Meanwhile, 1inch’s daily trading volume that day substantially surpassed that of the largest DeFi dApp, Uniswap. The latter’s performance was only $650 mln.

Overall, on May 12, 1inch’s market share among dApp users reached 23.1% among all DEXes, while that of Uniswap declined to 5.8%.

True, the crypto space is very volatile, and it’s currently going through a bearish period. But even in a bear market scenario, users apparently prefer to swap their coins via 1inch.

Stay tuned for more news and updates from the 1inch Network!