The 1inch Swap API helps DeFi Saver’s users optimize their swap transactions

DeFi Saver, an all-in-one decentralised super-app, leveraged the 1inch Swap API to offer its users more efficient swap transactions.

Swaps are an integral part of DeFi Saver. The app’s key features, such as Automation, Boost&Repay, Loan Shifter and Recipe Creator, all rely on DEX aggregation. In this sense, the 1inch Swap API has significantly contributed to optimizing DeFi Saver users’ trading experience, with the best rates and reliable swap routing.

What is DeFi Saver?

DeFi Saver is an all-in-one decentralised super-app that provides its users with all they need for DeFi management, as they can borrow and lend in more than 10 lending protocols from a single interface, shift loans, execute on-chain swaps and bridge their assets across the Ethereum mainnet, Optimism, Arbitrum and Base.

In addition, DeFi Saver is fully non-custodial and serves as an intermediary layer between users and protocols, meaning DeFi Saver does not have access to users’ wallets, and does not require depositing any funds into it.

How DeFi Saver deploys 1inch

DeFi Saver started off with manual DEX aggregation to help users find the best rates. As the user base grew and expectations evolved, a need arose for a more scalable solution that would optimize the Boost&Repay features and satisfy the demand. At that point, a decision to integrate the 1inch Swap API was made. Today, DeFi Saver does advanced meta-aggregation for each individual swap, basically aggregating DEX aggregators to point users to the best offers.

Over the years, DeFi Saver has noticed that certain DEX aggregators tended to stand out in terms of best rates and reliable routing, and 1inch was among the best performers. 1inch has generated the highest volume for DeFi Saver users - $1.1bln over the past three years and $117 mln over the past three months solely on the Ethereum mainnet.

The use of the 1inch Swap API has enabled DeFi Saver to improve the performance of its most popular features.

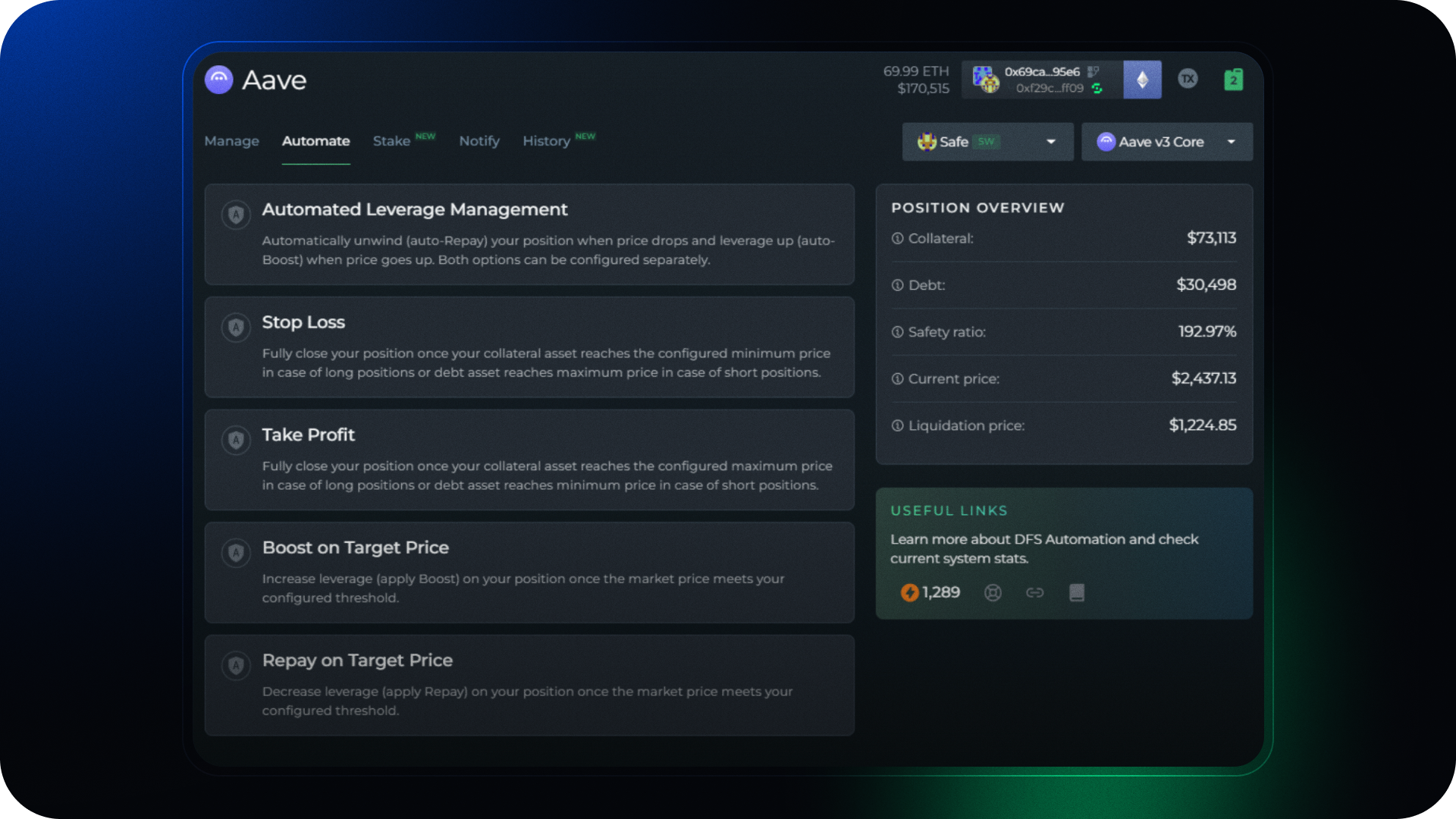

DFS Automation

DeFi Saver’s signature feature is Automation. Keeping track of market movements and making manual corrections can be a real pain in DeFi, and this is exactly what the Automation feature is designed to solve. A user can just provide their desired collateral and debt ratios, and they're all set and ready to go on that vacation, worry-free.

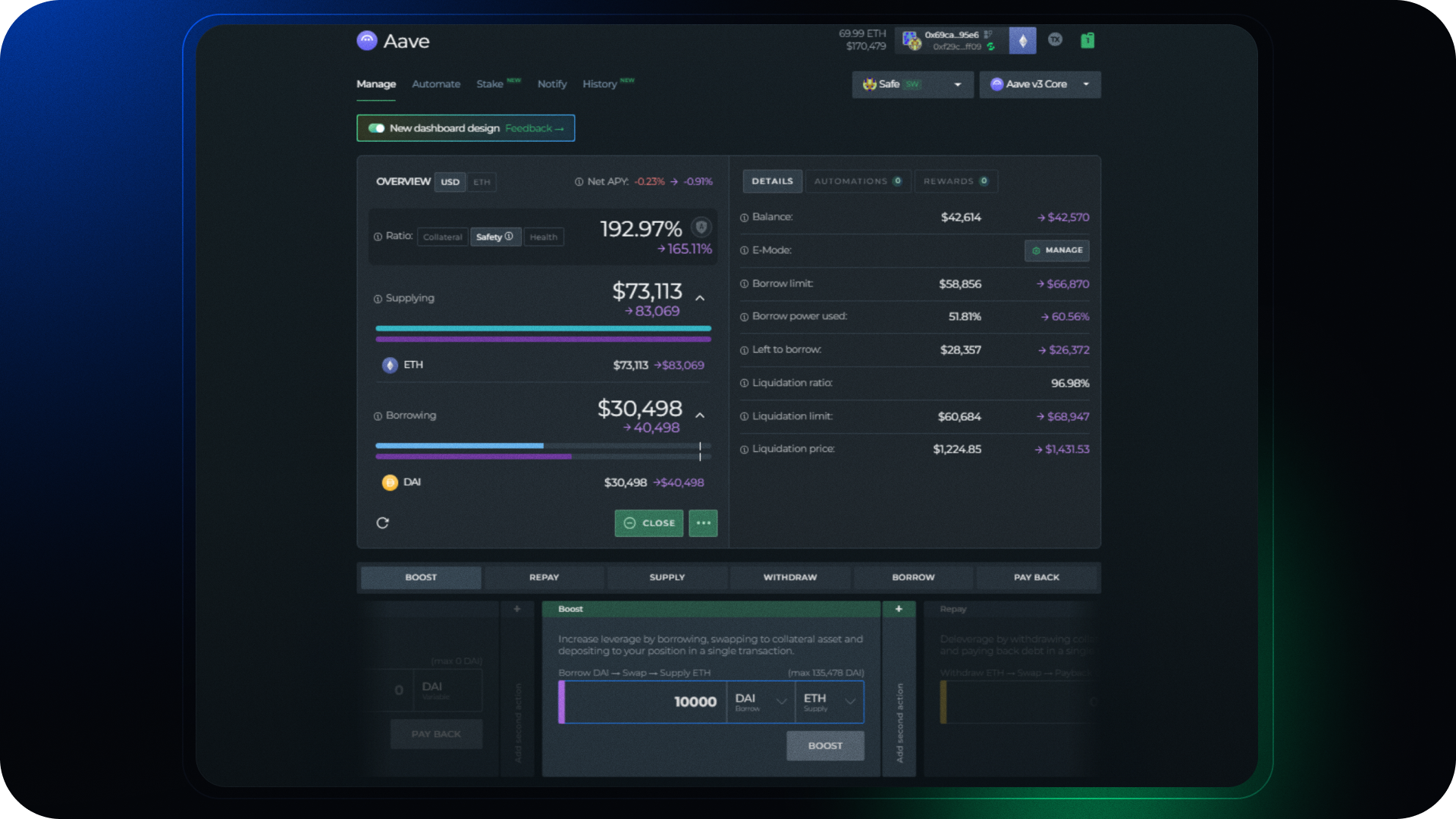

The Automation feature can increase or decrease a user’s leverage with the Boost & Repay options, meaning they can clear the debt using assets currently deposited as collateral (Repay), or enhance their leverage by acquiring more of the borrowed asset (Boost).

In simple terms, Repay pays off the user’s debt by withdrawing their collateral asset, swapping it into the debt asset and repaying a part of the debt. Meanwhile, Boost does the opposite. It borrows more debt, swaps it into the collateral asset and adds it back into the user’s position, all in one transaction.

Exchange feature

DeFi Saver’s Exchange feature executes token swaps in a fully non-custodial way. DeFi Saver will browse through every route the DEX aggregators are offering and find the best rate for the swap.

Recently, DeFi Saver introduced a new swap route optimization update that addresses the issue of invalid routes, especially in periods of high market volatility. Now, DeFi Saver simulates the swap and automatically switches to the next best available route, with 1inch as one of the DEX aggregator options.

Building the DeFi future together

"Ever since we started working on DeFi Saver in 2019, our main goal has been to provide the best experience possible at that moment,” said Nikola Janković, DeFi Saver CMO. “This meant creating the most impactful tools that help every DeFi user greatly optimize their workflow. A major part of this has always been finding the best routes with the best rates available in the ecosystem, which is why partnering with a reliable DEX aggregator, such as 1inch, made sense. By scanning liquidity pools and providing price quotes in less than a second, 1inch ensures that DFS users get the most competitive rates available.”

“As 1inch grows, so do we,” he concluded. “We look forward to seeing 1inch thrive and integrate new routes, tokens, and DEXs, as we work together to make DeFi more accessible and efficient for DeFi Saver users."

Stay tuned for more 1inch integration case studies!