1inch limit orders: a beginner’s guide

1inch makes placing limit orders on DEXes straightforward, efficient and attractive for first-time traders.

Every beginner with limited trading experience has various options to buy and sell cryptocurrencies. Usually, all newcomers are familiar with market orders that are used by default on most DEXes, where users enter the number of tokens they want to swap. 1inch, as an aggregator, helps users to perform a trade at the best price in the market, finding the most favorable option among numerous DEXes. This type of order is executed as fast as possible with a speed determined by the amount of gas the user wants to spend.

Meanwhile, those who want to swap at a specific price rather than at a price currently offered by the market, can place a limit order. This type of order allows traders to establish rates and time limits for exchanging crypto assets. But the transaction will be executed if the market reaches the price during the set time limit. However, if the order is filled, it happens at the desired price or better: at the limit price or lower price if buying and at the limit price or a higher price if selling.

Why place limit orders?

Limit orders come in handy in quite a number of cases, including high-volume trading, which can sometimes be worth waiting for market movements to occur.

When traders believe that some cryptocurrency is currently undervalued or inflated, or observe a constant rise or fall in the market, they set a limit order to sell as soon as the price goes up and to buy the cryptocurrency as soon as the price goes down.

Another convenience is that there is no need to constantly monitor the market, the order will be executed automatically or not executed in case the limit price doesn’t hit the market.

So, when a trader sees a price of ETH, for instance, at $1,500 but wants to buy it for $1,400, a limit order should be an option. The trader places a limit order, setting the rate at $1,400, which will be filled at this amount or lower.

But if some trader sells one ETH for $10,000 with a one minute time limit when the market rate is at $1,500, that is unlikely to meet a buyer for that amount, since the order does not match the market realities. Multiple other reasons can influence the order execution, like too many people willing to make a similar transaction, and market liquidity may not be sufficient to execute the order. Or the exchange rate may change quickly within a short time.

As most transactions fail when the limit is put too high or too low, traders usually set it just a little higher than the market in case of selling and a little lower than the market in case of buying.

Limit orders on DEXes

Overall, limit orders prevent users from missing investment opportunities and are used to limit potential losses and maximize unrealized gains. Previously, limit orders were available only on centralized exchanges, which appeared to be a barrier for many users to benefit from decentralized exchanges. With evolving and offering more advanced efficient tools meeting traders’ needs, most DEXes also enriched their variety of trading options with this feature.

DEXes’ usage has become even more relevant considering the increasing lack of trust in financial intermediaries due to some periodically introduced restrictions. Thus, traders, now unconstrained in options, can join the DeFi space, enjoying anonymity and the absence of regulatory authority. Among other crucial advantages is the higher security since DEXes are almost impossible to hack and self-control of the assets as a DEX does not have access to the keys kept in a non-custodial wallet.

1inch limit orders featuring gasless swaps

1inch is one of the largest DeFi projects boasting a limit order functionality. Moreover, 1inch offers a feature allowing for gasless order placing.

Currently, only the 1inch Limit Order Protocol provides gasless swaps for ETH. It enables users to place a limit order and exchange any token that supports permits for ETH, even with a zero ETH balance. Meanwhile, the list of these assets comprises almost all of the most widely used tokens on Ethereum, BSC, AAVE, Polygon, Avax, Arbitrum, Optimism, Gnosis Chain, Fantom and Aurora blockchains.

It includes many popular stablecoins, like USDC, USDT and DAI, as well as top in-use coins, like WBTC, AAVE, UNI, 1INCH, BAL and others.

Users do not need to buy ETH or transfer it from another exchange to place an order. They can immediately make a swap if having at least one of such tokens. And as there is even no signing additional permission required, placing a limit order turns out to be the easiest process ever existed on any dApp.

Placing a limit order guide

To perform a limit order, a user has to make just a few steps:

- Open the 1inch dApp and connect the wallet using these guidelines.

- Among Swap, Limit and P2P, select the tab ‘Limit’.

- After clicking on ‘Ethereum’ you will see the list of 10 blockchains in the drop-down menu.

- Choose the asset to sell among tokens you see in a drop-down menu under the ‘You sell’ section. To search for a specific token, enter its name in the search field. When using native networks’ tokens, note that many are presented in their wrapped versions, like WETH on Ethereum or WBNB on BNB Chain.

- Set the amount of assets you want to sell.

- Select the asset you want to buy by searching for the custom token, if it’s needed, or by using the list of offered tokens.

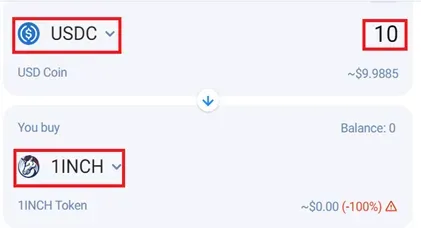

The example below shows placing a limit order when buying 1INCH tokens for USDC on Ethereum.

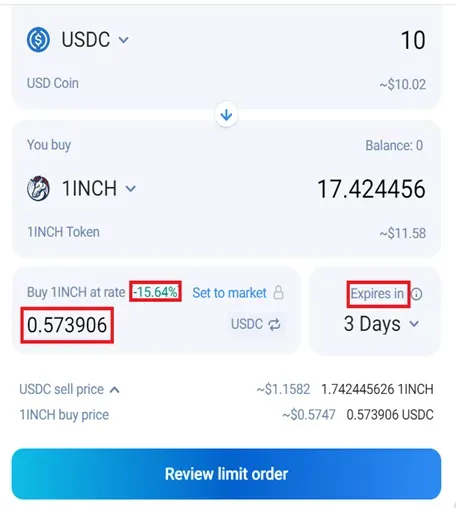

- Enter the preferred rate per unit of the asset in the ‘Sell at a rate’ field. The percentage of deviation from the market rate is shown automatically. You can establish the price for the asset you are willing to sell, or vice versa with the help of the tab reflecting your selected cryptocurrencies.

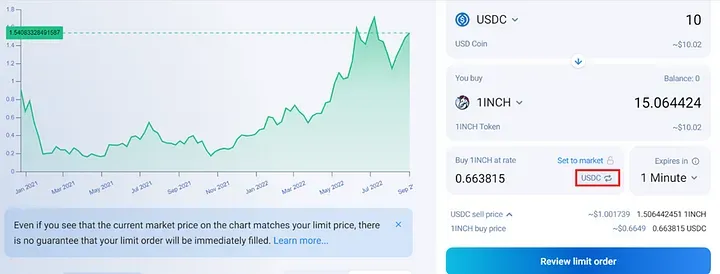

Switching to the tab ‘Set to market’ you will see assets’ current rates, so, to understand how many coins you get when you enter the desired rate for the coins you sell, you must lock this field.

On the left side of the menu, you can also find charts reflecting the latest market movements that can be helpful when deciding on your trade rate.

This example shows the price for 1INCH at a market rate and the number of tokens the user gets for this price. The tab for switching sell and buy rates options is marked red.

This example shows the difference between the buy limit order price and the current market rate. The amount of 1INCH tokens a user gets after entering the rate that is lower than the market offer, is increased. The time limit is set for three days.

- Establish the validation of the order, by selecting between the options offered in the ‘Expires in’ field or by entering the custom time period within which you want your order to be executed.

- Click on the ‘Review limit order’ button and sign the transaction you receive in your wallet. After doing so, you can follow your order status in the ‘Active orders’ section.

If you are exchanging tokens that do not support permits, click on ‘Give permission to use ‘ and also sign the transaction in your wallet, which in this case will require paying a small gas fee after the order is executed.

Placing a limit order on 1inch is easier and more profitable. You can test this feature by using a dApp and following the guide if necessary.

And stay tuned for more articles explaining 1inch features!