1inch integrates with Opium

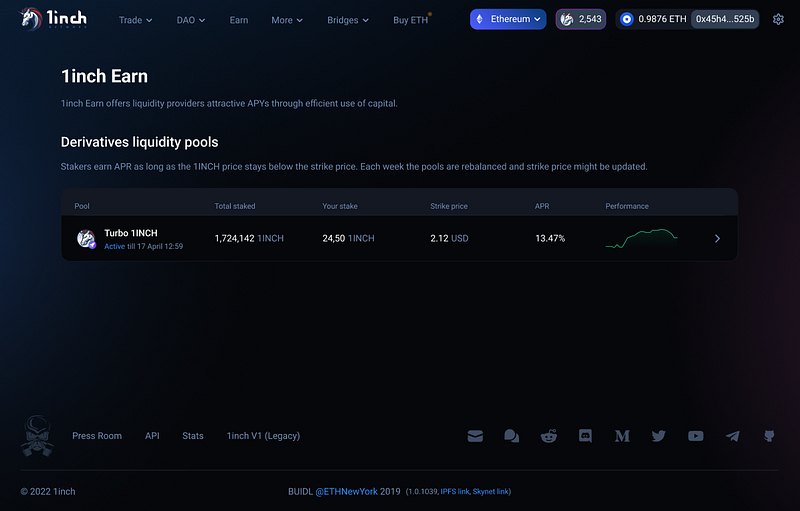

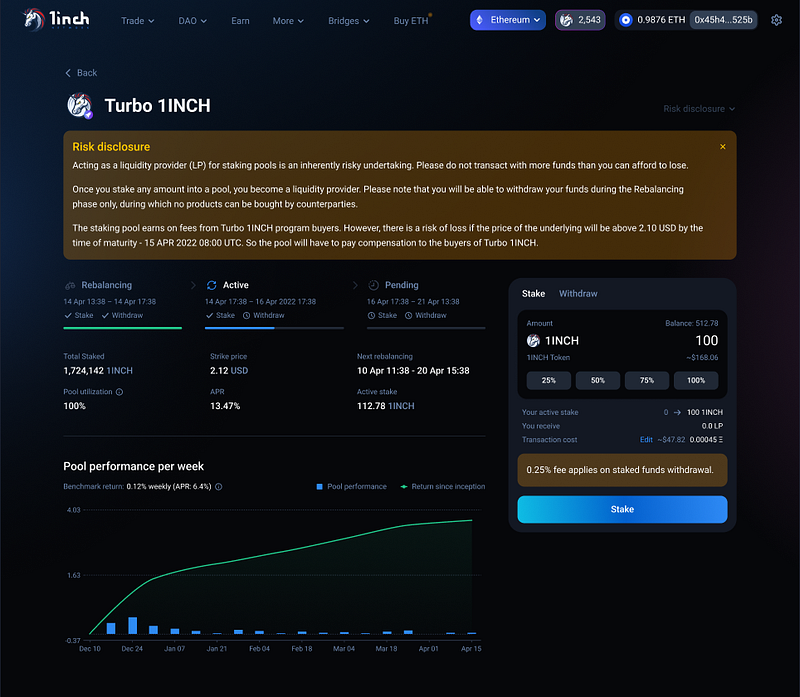

Thanks to the integration, Opium derivatives pools are now available in the 1inch dApp, creating extra earning opportunities for users.

The 1inch Network is glad to announce an integration with the derivatives platform Opium, which will enable users to take advantage of Opium derivatives pools directly in the 1inch dApp.

“Crypto derivatives is a promising segment in the DeFi space, and this collaboration with Opium will open up new opportunities for 1inch users,” says Sergej Kunz, 1inch Network co-founder.

Opium’s API featuring derivatives pools has been added to the 1inch dApp, with all transactions done through Opium’s smart contract.

Crypto derivatives work similarly to options contracts, enabling users to purchase insurance against, for instance, a significant decline in the price of ETH, or, conversely, to bet on an increase in its price.

For instance, a user can buy Turbo ETH with a strike price of $2,200, which means that if ETH’s price goes above $2,200 at a specified date in the future, the user will automatically collect the difference between the price at the time of purchase and $2,200.

Users providing liquidity to derivatives pools will collect yields coming from fees paid by buyers of derivatives. Based on performance at the time of launch, the annualized return for the Turbo 1INCH derivatives pool on Ethereum is projected to be 8.9%.

Initially, the Turbo 1INCH derivatives pool is available on Ethereum, while on Polygon, users can choose between Turbo 1INCH and Turbo ETH.

Opium is a protocol that facilitates creating, settling and trading decentralized derivatives. The protocol is based on a set of open-source Ethereum-based smart contracts. Users can launch decentralized derivatives or invest in derivatives.

In early 2021, the protocol released its token, OPIUM. Prior to the launch, a premine was run, as well as a $3.5 mln private sale, with buyers including Mike Novogratz, Galaxy Digital, QCP Soteria, HashKey, Alameda Research and others.

One of Opium’s first products were credit default swaps for Tether (USDT) aimed at insuring buyers in the event of Tether’s default.

Stay tuned for more exciting news about 1inch integrations and collaborations!