1inch integrates Uniswap V2 protocol

As we constantly work on encompassing the most innovative technology, we integrated Uniswap V2, the second iteration of promising Uniswap protocol, on day zero.

We are excited to share the news that Uniswap V2, the second version of the pooled automated liquidity protocol Uniswap, is now fully integrated into our dApp and protocol.

As you know, we always keep track of all innovations in the DeFi space and integrate the most advanced technology to provide our users with diverse and lucrative options for swaps and interest income on their tokens.

We believe that Uniswap is one of the most promising and advanced protocols in the DeFi space. Recently, it has been generating quite a lot of traction as it’s quite efficient and easy to use and, in addition, is a public good not owned by any company.

Uniswap’s share in the total crypto transaction volume is on the rise, and we expect this protocol to become the “go-to” solution for crypto exchange in the future.

While Uniswap V1 supported only ERC20/ETH pairs, the protocol’s second version provides an unstoppable opportunity for any possible ERC20 pairing. As a result, for instance, two different tokens could be supplied to the same pool.

As soon as the second version of the Uniswap protocol was released, we fully integrated it in our dApp and protocol, which is on top of other protocols and enables easier transactions with tokens.

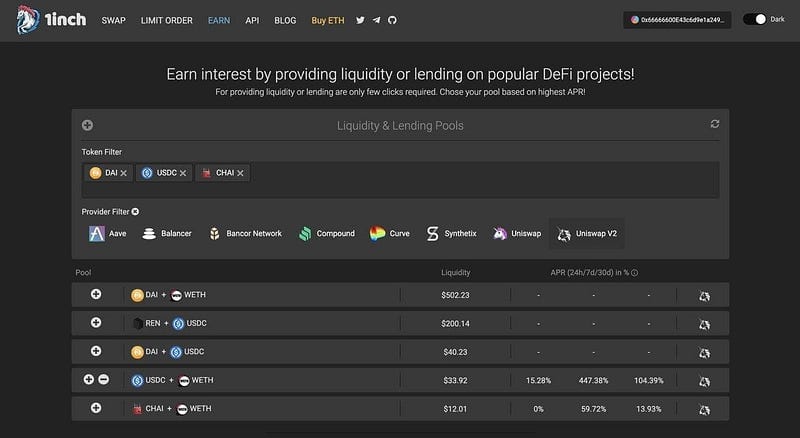

Now we offer a user interface (UI) that enables creating liquidity pools and supplying funds to those pools.

In the UI, users can see a list of all Uniswap V2 liquidity pools for selected tokens, including the pool’s capitalization and annual percentage rate (APR).

What does this integration mean for developers and wallets that integrate our protocol? They will be able to get access to more liquidity.

As for regular 1inch users, they can take advantage of the Uniswap V2 integration by providing liquidity to Uniswap pools. Funds provided by users to any Uniswap pool are used for token swaps, and for each swap, a transaction fee is charged.

The collected fees are distributed between all pool participants — users who have provided liquidity to the pool — in the form of interest, depending on their share of liquidity provided to the pool.

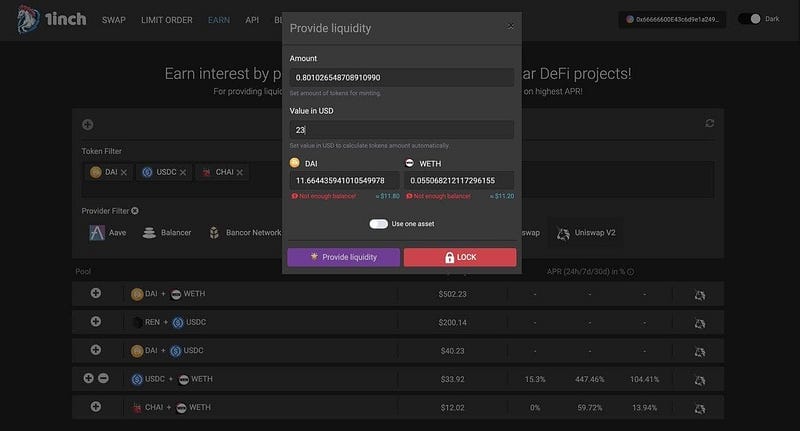

Users can either buy pool tokens, or provide liquidity in any tokens they hold, which will be converted into pool tokens in the 1inch smart contract.

All you need to do to begin collecting an interest income from Uniswap pools, is to go to the Earn section in our dApp.

In addition, any user can create their own pool for any token pair, except for ETH, and provide liquidity to that pool.

Finally, the Uniswap protocol can be used for token swaps. As liquidity grows in the pool, it will be able to offer users more attractive token exchange rates.

Do you want to check out how Uniswap V2 works? Go ahead and test it right now!

How it works video on Youtube:

Subscribe to our Twitter account and Telegram channel!