Sergej Kunz, 1inch Network: “Decentralized exchanges and aggregators drive DeFi growth”

As the decentralized exchange segment continues to show remarkable performance, the 1inch Network solidifies its status as a major player in the industry.

Lately, the 1inch Network’s user base has seen sustainable growth, as users have been actively choosing the network over other projects. In recent months, thanks to its efficiency and user-friendliness, 1inch has been able to increase its share of the DEX segment. Since the beginning of the year, the number of 1inch users has grown sevenfold (from 80k to 600k).

In this article, we’ll discuss the DEX segment’s recent trends, focusing on its major players and their performance.

DeFi still thriving

Regardless of uncertainty in the crypto space, the decentralized finance (DeFi) segment remains one of its main growth drivers.

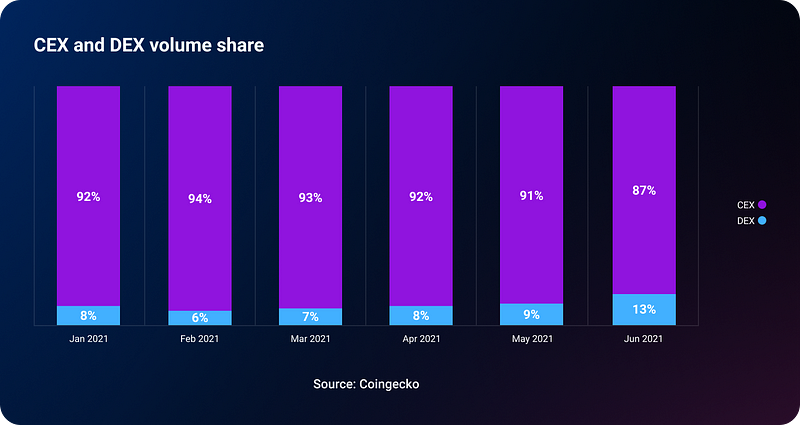

Traders increasingly use decentralized exchanges (DEXes), driving up their market share at the expense of centralized exchanges. The situation has not been any different even during the current market correction period.

Over the last six months, the total trading volume generated by decentralized exchanges has seen a major uptake. It tripled from approximately $100 bln in January to $300 bln in May before dipping to about $200 bln, according to Coingecko.

However, despite the market correction period in the second quarter of 2021, DEXes have been successfully luring business away from centralized exchanges. Between January and June, while DEXes’ total trading doubled, the CEX segment saw much more modest growth from $1.2 trillion to $1.3 trillion.

Towards dominance in user base

When comparing Ethereum-based DeFi protocols, user base emerges as the most important metric, as it directly reflects a dApp’s popularity with users and can, therefore, be more revealing than any other parameters.

For instance, user base is a more reliable metric than trading volume, as volume is more vulnerable to various manipulations. In addition, the lion’s share of trading volume is often generated by a small proportion of wallets and, as a result, doesn’t reflect a project’s popularity and growth prospects.

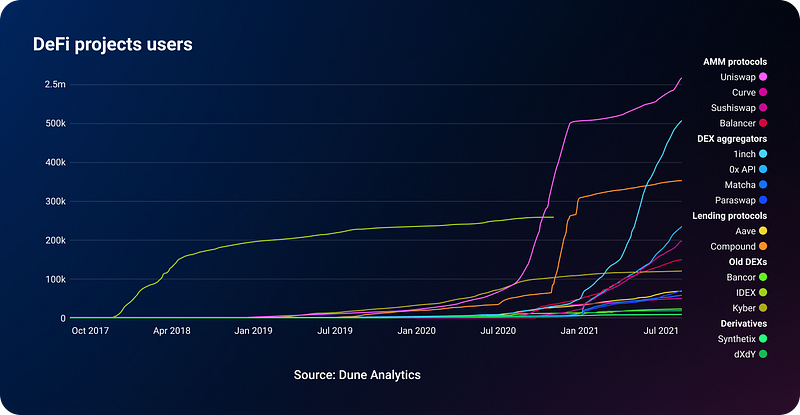

With about 2.5 mln unique users (addresses), Uniswap is the segment’s leader, followed by 1inch, which has 600,000 users, and Compound with about 360,000 users.

Over the past few months, AMM protocols and DEX aggregators have seen stronger growth in user numbers than other DeFi projects. Still, just a handful of projects can boast growing user bases as the bearish trend continues.

In this chart, a swap can be attributed to several projects involved in it. Source: Dune Analytics

As you can see from the chart above, the user bases of lending/borrowing protocols, such as Compound and Aave, have hardly grown since the beginning of this year.

Similarly, older DEXes, including Kyber or IDEX, have seen a rather weak uptake in user numbers.

The only category of DeFi projects that has shown robust growth is AMM-based DEXes and DEX aggregators, such as 1inch, Uniswap, SushiSwap and 0x.

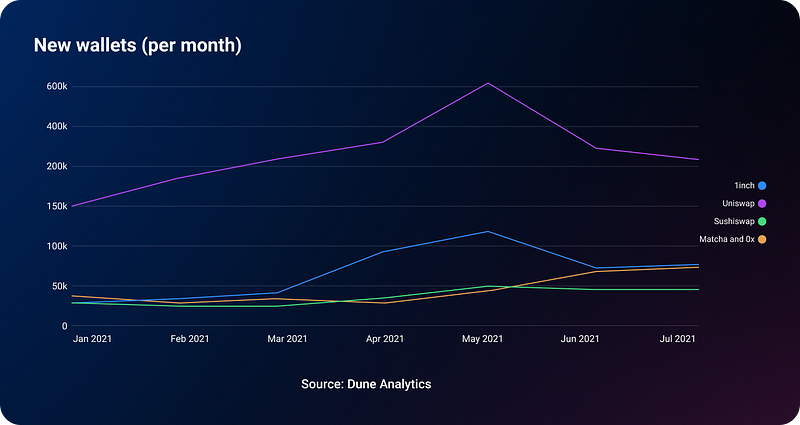

In this chart, a swap can be attributed to several projects involved in it. Source: Dune Analytics

The number of new wallets has been falling since May for all projects, except for Matcha. However, for Uniswap, the decline in new wallets has been more significant than for other projects.

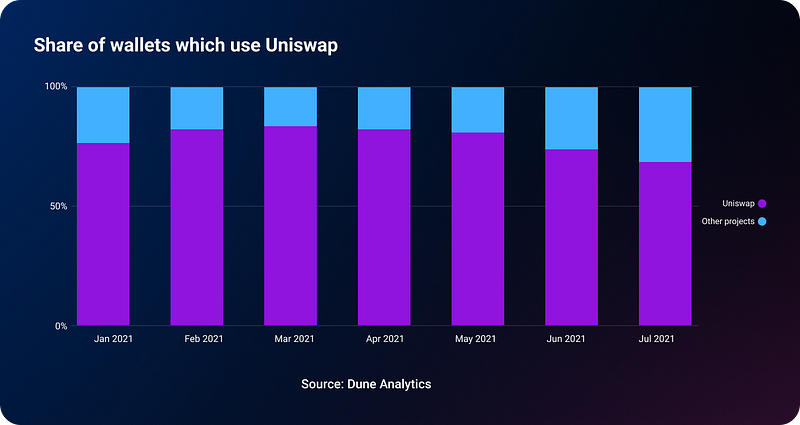

In this chart, each wallet is counted only once. Source: Dune Analytics

The share of wallets which use Uniswap has been shrinking, while the share of wallets which use other projects has been rising.

The rise of DEX aggregators

In this chart, each wallet is counted only once. Source: Dune Analytics

One of the trends observed in recent months and reflected in the chart above is that more and more users prefer to use outside aggregation services, such as MetaMask and DEX aggregators, as opposed to trading directly on DEXes. As a result, trade volumes on services of that kind have been on the rise.

DEX aggregators, such as 1inch and Matcha, have been able to offer users better swap rates than they would get by swapping directly on Uniswap, SushiSwap and other DEXes. Therefore, users have been increasingly opting for DEX aggregators, boosting their market share.

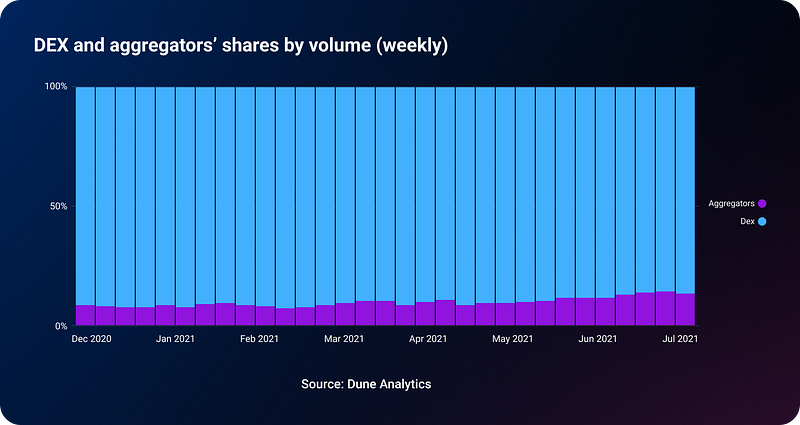

As a result, since the beginning of 2021, the share of DEX aggregators volume has doubled from 7.5% to 15%.

Lower fees as a factor

A major factor for users choosing a DEX or a DEX aggregator is the amount of fees they will have to pay on swaps.

Overall, two types of fees are involved in swaps — trading fees charged by projects and gas fees automatically applied to any transaction on the Ethereum network.

For Uniswap users, trading fees range from 0.05% to 1%, depending on specific pools, while

SushiSwap charges a flat fee of 0.3% on all swaps. The advantages of DEX aggregators, such as 1inch, is that they don’t charge any trading fees on top.

DEX aggregator users only have to pay Ethereum gas fees, but the aggregators may take extra steps enabling users to reduce their gas costs.

The chart below displays gas costs incurred by users of several projects as total gas cost in USD divided by the July 2021 swap volume. As you see, 1inch has been consistently offering the lowest gas prices, while Uniswap’s gas costs are the highest.

In this chart, each wallet is counted only once. Source: Dune Analytics

Since the recent London hard fork in the Ethereum network earlier this month, another major factor impacting users’ gas spending in the Ethereum network has been the number of ETH tokens burned by projects.

The big picture

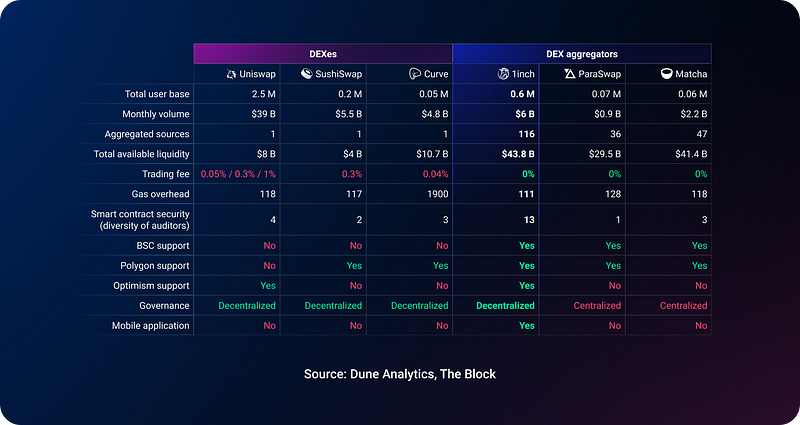

Apart from user base and the size of swap fees, several additional factors come into play when comparing performances of DEXes and DEX aggregators. They include smart contract security, multi-network functionality, availability of a mobile app, governance opportunities and others.

In the chart below, the six most popular Ethereum-based projects used for swapping crypto assets are compared by several parameters. They are split into two categories, DEXes and DEX aggregators.

As you can see, by swapping via DEX aggregators, users get more attractive conditions than by swapping directly on DEXes.

In turn, 1inch is ahead of the competitors in several crucial metrics, as it offers the highest number of aggregated sources, alongside low gas costs, the absence of trading fees, high smart contract security, support for Binance Smart Chain, Polygon, Optimistic Ethereum, and the availability of governance and a mobile app.

MetaMask as an ‘aggregator of aggregators’

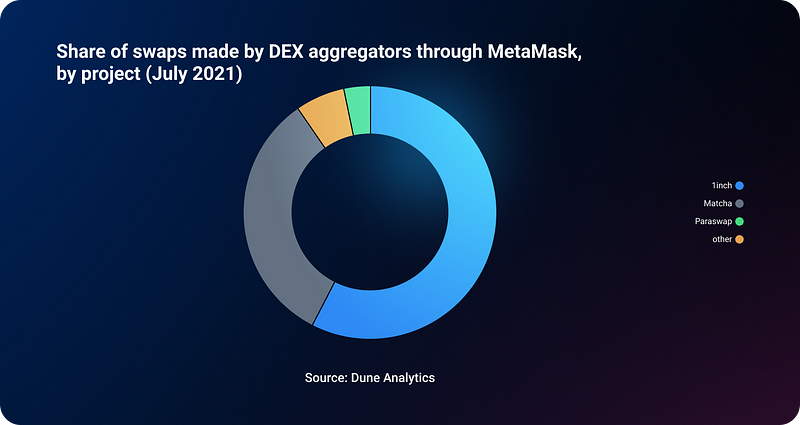

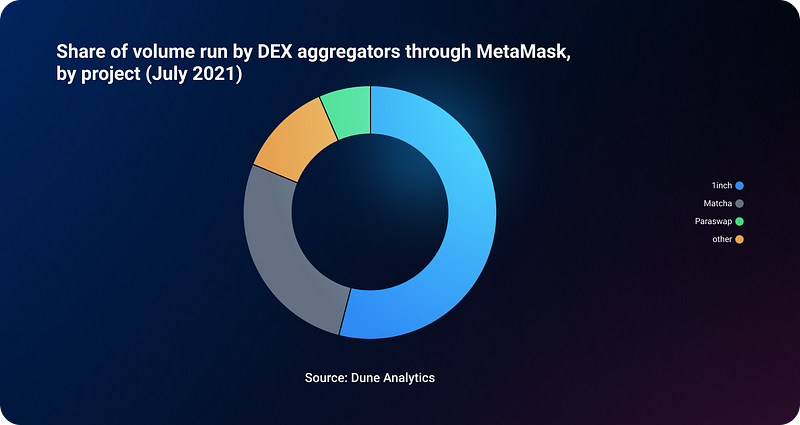

MetaMask, the most popular wallet in the Ethereum ecosystem, occupies a unique position in the DEX segment, as it has a built-in aggregator for liquidity from other aggregators, including 1inch, ParaSwap and Matcha. Basically, MetaMask acts as an ‘aggregator of aggregators’.

However, unlike DEX aggregators that charge no extra fees on top of DEXes’ trading fees and gas costs, MetaMask earns by charging fees of 0.875% per swap.

The charts below show the main DEX aggregators’ shares on MetaMask in terms of volume and swap numbers for July 2021.

Source: Dune Analytics

Source: Dune Analytics

As you can see, 1inch is the most actively used aggregator on MetaMask, followed by Matcha.

Moving forward

As the above data shows, swapping crypto assets on DEX aggregation services has recently become more profitable for users than direct swaps on DEXes.

As a result, DEX aggregation services, including the 1inch Network, have outperformed DEXes by most parameters.

Meanwhile, in the DEX aggregation segment, the 1inch Network has demonstrated better dynamics than its competitors, emerging as a major growth driver across the entire DEX and DEX aggregation space.